6.5TWh Surge: Lithium Ion Batteries Power Up

Table of Contents

- 6.5TWh Surge: Lithium Ion Batteries Power Up

Global Lithium-Ion Capacity to Hit 6.5TWh: A Look at the Future of Green Tech

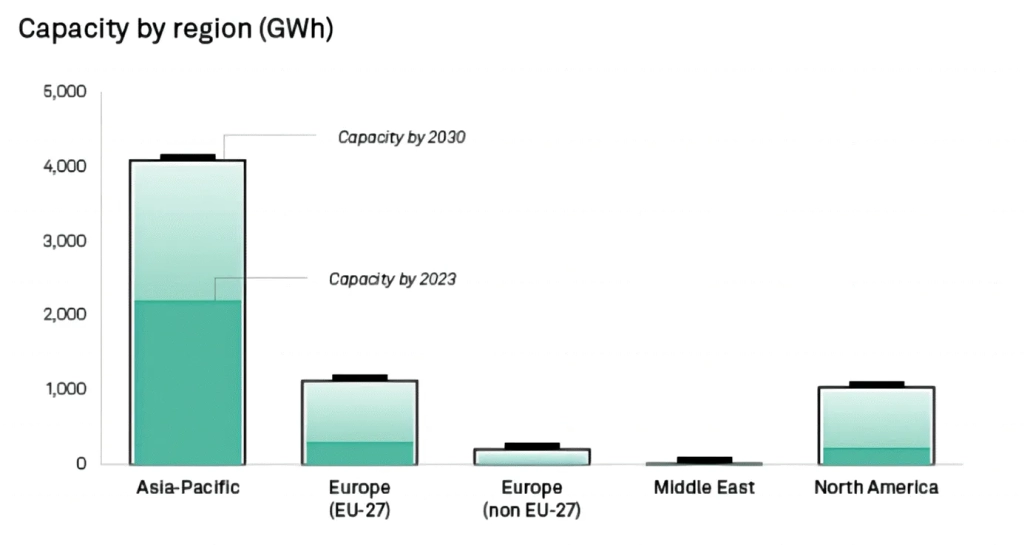

Two cornerstones of the global green agenda — vehicle electrification and renewable energy storage — hinge on lithium-ion batteries. Projections indicate that by 2030, manufacturing capacity will hit 6.5TWh, with China claiming over half the market share, while North America and Europe are set to host over 1 TWh of lithium-ion battery capacity each.Lithium-ion batteries play a pivotal role in driving the electrification of the transport sector to slash carbon emissions and are integrated with low-carbon power generation to better buffer the variability of renewable energy. With numerous short-to-mid-term carbon reduction targets catalyzing investments in lithium-ion production capabilities, the demand for batteries is forecasted to surge with a compound annual growth rate (CAGR) of 22.3% from 2022 to 2030. Beyond energy storage and portable electronics, by 2030, the auto and transit sectors will command a staggering 93% of the market share.As of March, global lithium-ion battery capacity has reached a robust 2.8TWh. Accounting for various capacity expansion or new build plans released over the past few years — excluding potential delays or expansions, as well as tracking of shelved or canceled projects — capacity is on track to double by 2030, reaching 6.5TWh. Planned lithium-ion capacity should be sufficient to meet the surging demands, with the EV sector alone requiring 3.7TWh by 2030.While China will continue to fuel the growth in lithium-ion capacity production, due to an already significant base, it's projected to cede some market share between 2023 and 2030, with a slower expansion rate. Europe currently trails and is poised to maintain its position as the second-largest market, followed by North America, both expected to exceed 1TWh capacity by 2030. North America's growth is slightly more aggressive, with a CAGR of 22% from 2023 to 2030, compared to Europe's 16%. The boost in North America's output is largely from the U.S., with only two projects in progress in Canada.India also has ambitious plans to ramp up its lithium-ion battery manufacturing capacity to 145 GWh by 2030, up from a mere 18 GWh currently, positioning it fifth globally by the end of the forecast period, just behind Hungary. The Indian government estimates a need for 120 GWh of lithium-ion battery capacity by 2030 to satisfy the demands of EVs and static storage — a target that appears attainable if projects proceed as planned. India's EV sales are predicted to escalate from just 60,000 units in 2022 to 1.2 million units by 2030, with the U.S. projected at 4.1 million units, as the government aims for a 30% EV adoption rate by 2030.Meanwhile, Hungary is emerging as a preferred destination for Chinese battery manufacturers, with CATL and EVE already funneling nearly $10 billion into battery plant investments.