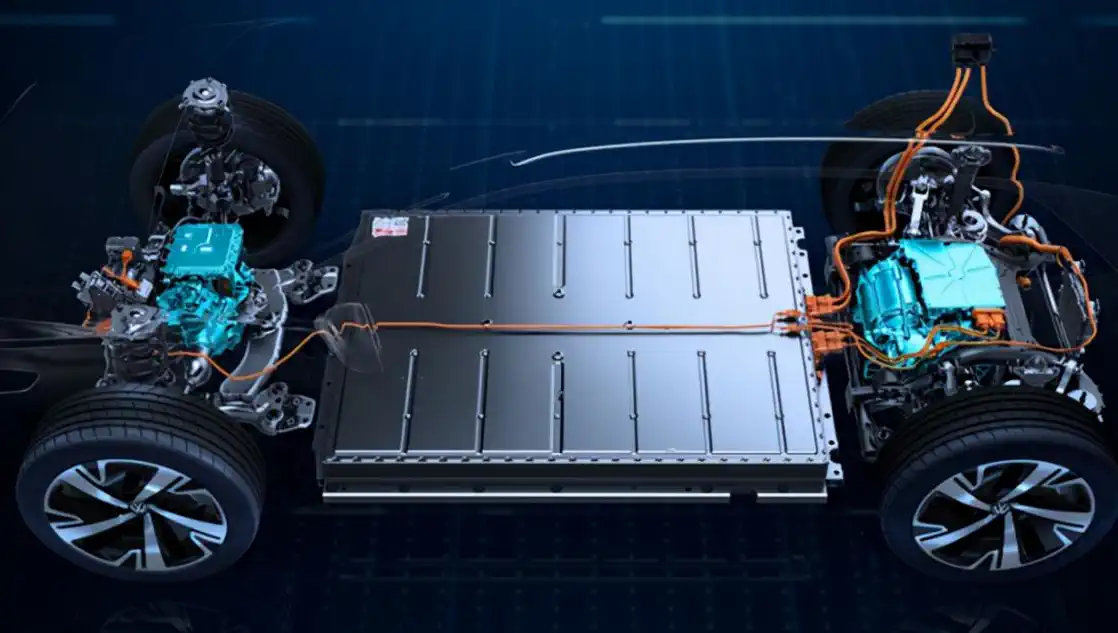

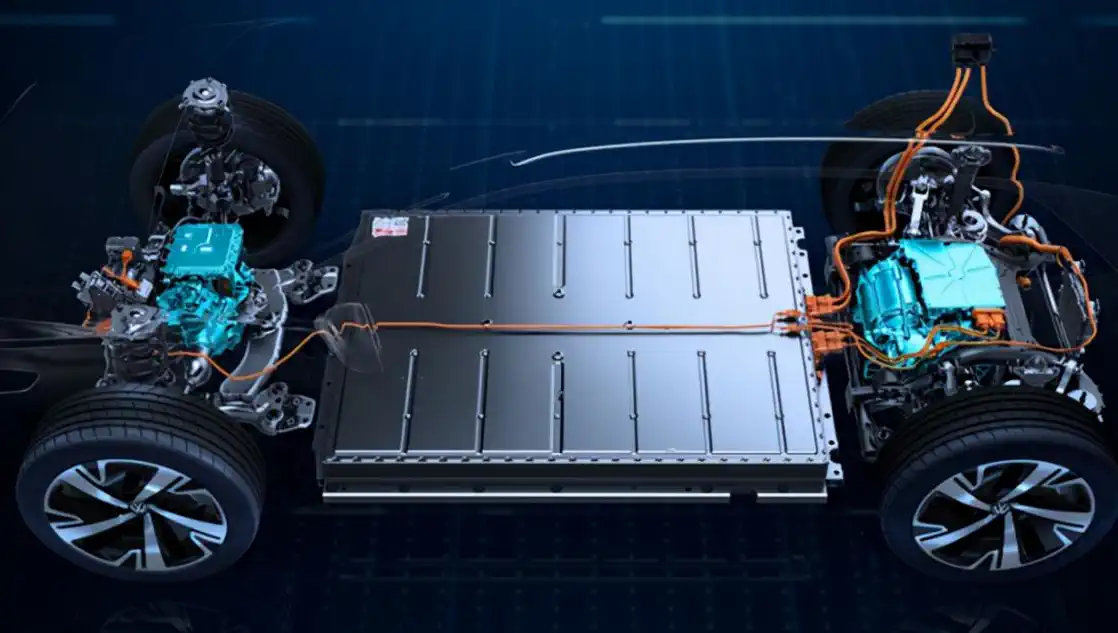

LFP Batteries Surge in Electric Vehicle Market

Table of Contents

- LFP Batteries Surge in Electric Vehicle Market

The demand for lithium iron phosphate batteries (LFP) is growing fast. This increase is helping many companies, especially those that make the materials for these batteries. Leading companies like CATL and BYD are working hard to improve lithium iron phosphate battery technology to make these batteries better and cheaper. This is great news for the electric vehicle industry, as more car makers are using these advanced batteries in their new models. As a result, even smaller companies are ramping up their production to keep up with the rising demand.