Evolving Energy in Europe: Storage's Rising Star

Table of Contents

UK Dominates European Energy Storage with 42% Share

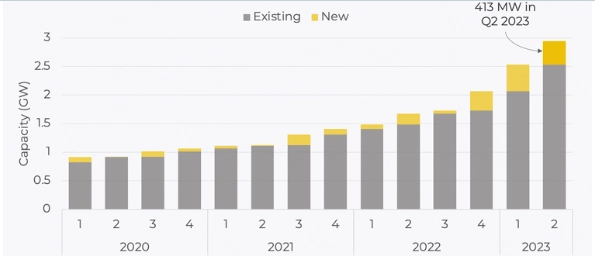

On July 19, 2023, the European Parliament approved a plan. The plan changes the design of the power market. The goal is to use less fossil fuel. The plan supports energy storage and other things. It gives them a good return on investment. Energy storage is very important for reliable energy.The European Association for Energy Storage (EASE) gave some numbers. In 2022, Europe added 4.5GW of energy storage. 2GW was before the meter. 2.5GW was for homes. The UK led the way. They had 42% of the storage. Ireland, Germany, and France followed. Their shares were 16%, 12%, and 11%.Most storage projects in Europe earn from frequency response services. But, this market will get full. Storage projects will look at price differences and capacity markets. The UK, Italy, Poland, and Belgium are ready. They have a system for energy storage.Italy had an auction in 2022. They plan to add 1.1GW/6.6GWh of battery storage by 2024. They will be second after the UK in storage. In 2020, the UK removed a limit. They made big storage projects faster. Now, 20.2GW of projects got approved. 4.9GW is already connected. There are 33 big sites. They will be done in 3-4 years. 11GW of projects will be approved soon. 28.1GW of projects are still waiting.More renewable energy projects are coming. Renewable energy and storage are pairing up. In 2021, 3542MW of solar projects were registered. 1725MW had energy storage. That's 48.7%. In 2020, it was only 30.5%.UK Battery Storage: Diverse Income Sources Explored

In the UK, battery storage projects have multiple ways to earn. These include services, capacity markets, and spot power markets.Most of the money comes from frequency response services. They make up over 60% of the income. Capacity markets offer long contracts. These can last up to 15 years. Developers and financiers like this. It has made UK storage grow. Right now, spot trading income is low for storage projects. With more renewable energy, power prices change a lot. So, there might be more chances to make money in the future.Modo Energy shared some data. From 2020 to 2022, the average UK storage income was 65, 131, and 156 pounds/KW/year. In 2023, natural gas prices fell. Frequency market income dropped. We guess future income will be between 55-73 pounds/KW/year. This doesn't include capacity market income. If we look at the UK storage cost, which is 500 pounds/KW, the return period is 6.7-9.1 years. If the capacity market pays 20 pounds/KW/year, it can be less than 7 years.The European Association for Energy Storage made a prediction. In 2023, Europe will add 3.7GW of big storage. That's a 95% increase. The UK, Italy, France, Germany, Ireland, and Sweden are leading. In 2024, Spain, Germany, and Greece will grow fast with policy support. They will help Europe add 5.3GW, a 41% rise.