ACC Reevaluates Plans Due to EV Market Slowdown

Table of Contents

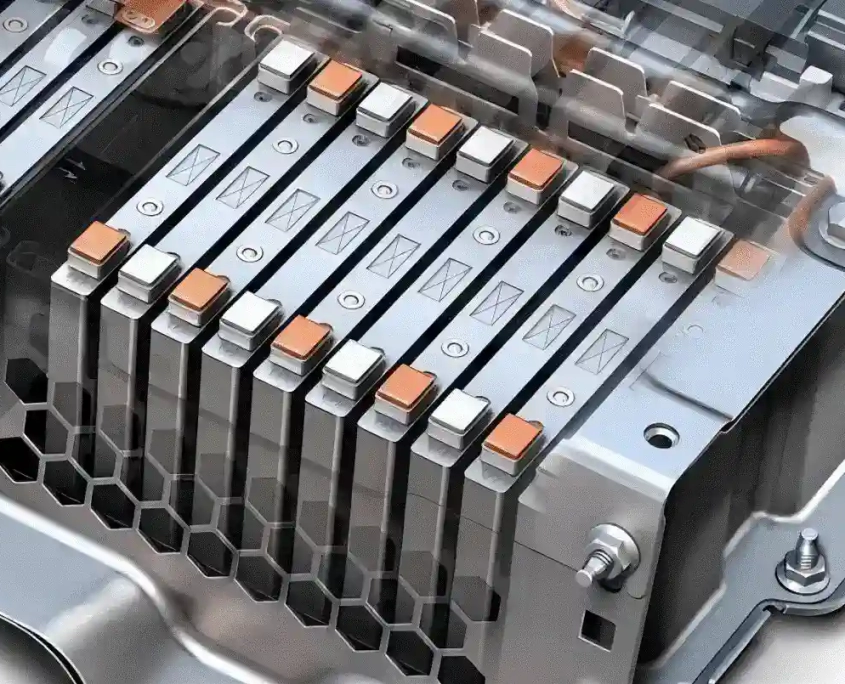

Battery manufacturer ACC has paused its plans to build factories in Germany and Italy amid slower growth in electric vehicle sales. Automakers and their suppliers are adjusting their production plans for electric vehicles and batteries. According to European Automotive News, ACC is reevaluating its future strategy.

ACC was established in 2020 as a joint venture by Stellantis, Mercedes-Benz, and TotalEnergies, with technical support from its subsidiary Saft. The company focuses on electric vehicle battery technology. Last December, ACC’s first battery factory in Billy-Berclau Douvrin, France, began producing batteries for Stellantis.

Stellantis CEO Carlos Tavares spoke at the factory’s inauguration, stating, “When we formed our partnership in 2020, we set an ambitious global timeline to develop electric vehicle batteries to power our electric mobility plans.” Thanks to the successful launch of its first factory, ACC secured €4.4 billion in debt financing this February to support the construction of three lithium battery gigafactories in France, Germany, and Italy, and to fund research and development.

ACC CEO Yann Vincent noted, “The transition to automotive electrification is still ongoing. Our customers can fully rely on strong and dependable European companies like ACC, and we see the confidence people have in the ACC project.” However, less than four months after the last round of financing, ACC has halted the construction of its factories in Germany and Italy.

European Electric Vehicle Sales Slow Down

European electric vehicle sales are slowing down. This slowdown, along with cost concerns, led ACC to halt its factory construction plans. The company stated on Tuesday that it needs to develop low-cost batteries for cheaper electric vehicles and will confirm its timeline by late 2024 or early 2025.

Yann Vincent mentioned that although electric vehicle sales in Europe grew by 14.8% year-over-year in April, the growth rate was slower than that of traditional hybrid electric vehicles (HEV). He believes that future demand for electrification will focus mainly on the mass market. Western electric vehicle manufacturers have not clearly targeted this market yet, but Chinese automakers have started to do so, especially in Europe.

Carlos Tavares, who once expressed ambitious plans during the inauguration of the first battery factory last year, has recently adjusted his tone. He mentioned that they will adapt their investment plans in electric vehicles to match the sales growth rate of the market. “We cannot control the speed of electric vehicle growth,” he added.

Europe’s Electric Vehicle Transition Needs to Accelerate

European electric vehicle transition needs to speed up. According to American tech media Electrek, the decision to pause the construction of electric vehicle battery factories makes no sense. They noted that under the EU’s goal of achieving net-zero emissions by 2050, Europe needs more electric vehicles. The current growth rate of electric vehicle adoption in Europe is too slow. Therefore, Europe’s shift to sustainable transportation needs to accelerate, not slow down.

The commentary also mentioned that reacting to market trends isn’t very meaningful. If ACC waits for the European market’s electric vehicle demand to surge before building factories, like the planned German factory that wouldn’t produce batteries until 2027, it will miss the trend.

Swedish battery manufacturer Northvolt shares this view. In March, Northvolt CEO Peter Carlsson, at the groundbreaking ceremony for their new German factory, said, “There is no doubt that we are moving from internal combustion engines to electric vehicles.” He added, “Although the overall trend of electric vehicles has slowed down, when you step back and look at this shift, you’ll see that the big trend and potential change are still there.’

Learn More About Battery

https://manlybattery.com/wp-content/uploads/2022/04/Seven-main-performance-indicators-that-determine-the-quality-of-sound.jpg

500

650

administrator

https://manlybattery.com/wp-content/uploads/2024/09/Manly-battery-logo2.webp

administrator2022-04-09 06:17:022022-11-22 07:10:49Seven main performance indicators that determine the quality of sound

https://manlybattery.com/wp-content/uploads/2022/04/Seven-main-performance-indicators-that-determine-the-quality-of-sound.jpg

500

650

administrator

https://manlybattery.com/wp-content/uploads/2024/09/Manly-battery-logo2.webp

administrator2022-04-09 06:17:022022-11-22 07:10:49Seven main performance indicators that determine the quality of sound https://manlybattery.com/wp-content/uploads/2022/04/Introduction-of-sound.jpg

500

650

administrator

https://manlybattery.com/wp-content/uploads/2024/09/Manly-battery-logo2.webp

administrator2022-04-09 03:38:302022-11-22 07:06:50Introduction of sound

https://manlybattery.com/wp-content/uploads/2022/04/Introduction-of-sound.jpg

500

650

administrator

https://manlybattery.com/wp-content/uploads/2024/09/Manly-battery-logo2.webp

administrator2022-04-09 03:38:302022-11-22 07:06:50Introduction of sound https://manlybattery.com/wp-content/uploads/2022/04/The-battle-between-speaker-intelligence-and-sound-quality.jpg

500

650

administrator

https://manlybattery.com/wp-content/uploads/2024/09/Manly-battery-logo2.webp

administrator2022-04-08 04:07:582022-11-22 04:02:53The battle between speaker intelligence and sound quality

https://manlybattery.com/wp-content/uploads/2022/04/The-battle-between-speaker-intelligence-and-sound-quality.jpg

500

650

administrator

https://manlybattery.com/wp-content/uploads/2024/09/Manly-battery-logo2.webp

administrator2022-04-08 04:07:582022-11-22 04:02:53The battle between speaker intelligence and sound quality