More Products

Advanced Manufacturing Technology For Low Carbon Energy In EU

The Core Of Low Carbon Energy Technology: Lithium Ion Battery

The European Union Commission issued a report. This report examined the market and technology of key net-zero manufacturing technologies. It found that the competitiveness of the EU’s net-zero industry changes. This change depends on the specific net-zero technologies and their supply chains. Nevertheless, there are substantial vulnerabilities present. Also, there are considerable risks in supply security.

Rapid Growth of Low Carbon Energy in Europe, But Limited Energy Storage Batteries

Batteries are crucial for shifting power systems to renewable energy. They’re used mainly in electric cars and fixed energy storage. Right now, the EU needs about 140 GWh of lithium ion batteries per year. This demand will likely surge in the coming years. However, projections for 2030 vary, from 362 GWh to 1000 GWh per year. Concurrently, the market for fixed applications keeps growing.

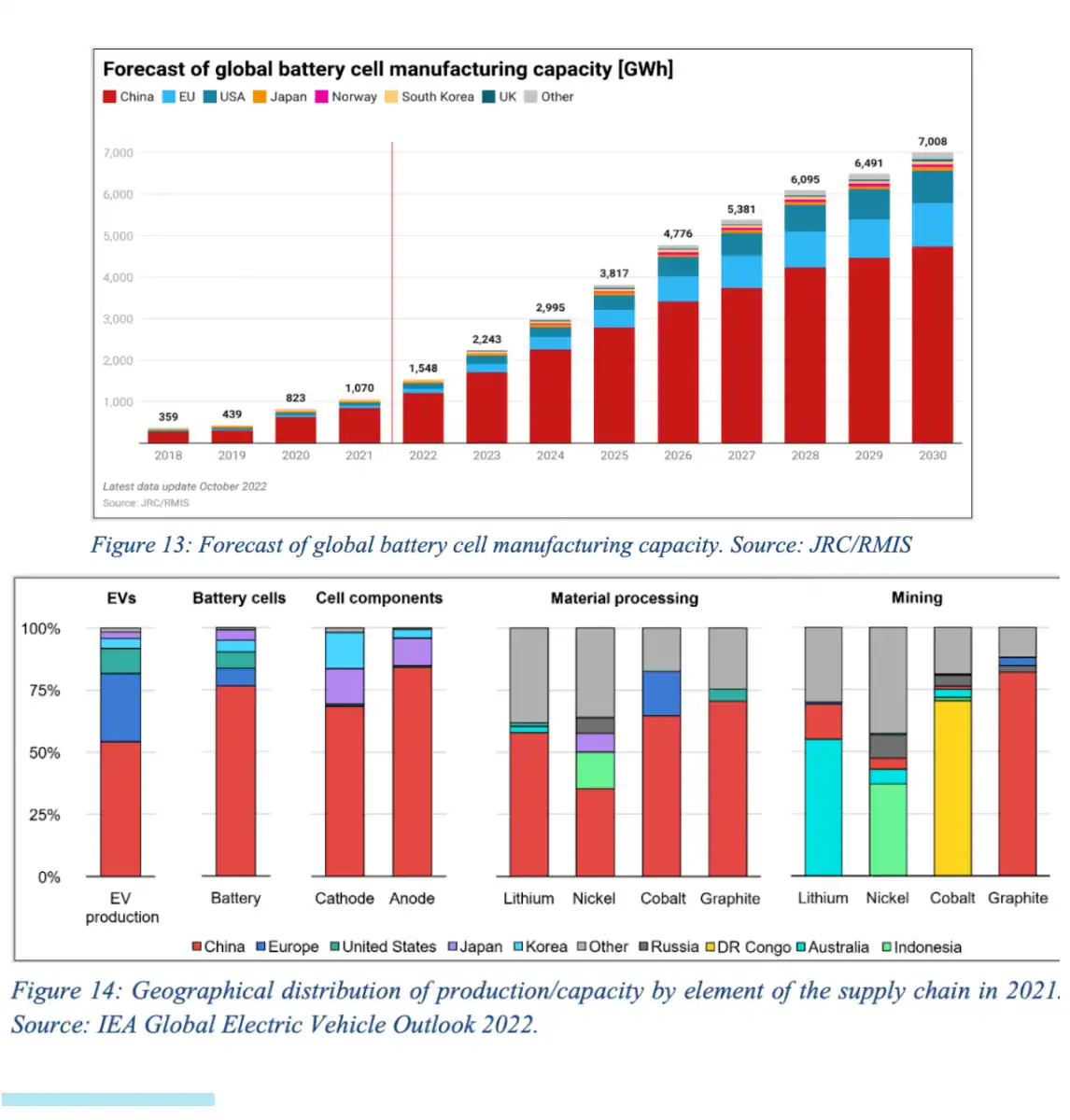

The EU plays a key role in car production. This is particularly true for electric vehicle batteries and car sales, contributing nearly 8% to the EU’s GDP. In 2022, electric vehicle sales in the EU reached just over 2 million. This accounts for 21.5% of the car market share. The previous year, they sold 1.75 million electric vehicles. On the other hand, China sold 3.3 million and the U.S. sold 630,000. Both these markets are growing quicker than the EU’s. In 2021, the global boost in electric vehicle battery capacity was 278 GWh. By 2030, this annual increase could surpass 2100 GWh.

Fixed energy storage batteries have less application compared to electric vehicle batteries. In 2021, the global energy storage installed capacity stood at 22 GWh. By 2030, it’s predicted to reach about 250 GWh. However, the EU’s energy storage capacity in 2021 was just 3.7 GWh, trailing behind the U.S. and China. Even though renewable energy installations in Europe are quickly expanding, energy storage battery installations are not. The reason is that the EU’s power grid is stronger and denser, reducing reliance on storage.

The Cost Of Lithium Ion Battery

BloombergNEF conducted an annual battery price survey. It revealed that global battery prices dropped 89% in 2021. The price went from over $1,200 per kilowatt-hour in 2010 to $132 in 2021. This price is an average, considering all regions and uses. It includes various electric vehicles, buses, and fixed energy storage batteries. Battery costs are cheapest in China, at $111 per kilowatt-hour. They’re 40% and 60% more expensive in the US and Europe, respectively. This trend reflects the use of cheap lithium iron phosphate batteries, especially in China.

In 2022, the EU’s electric vehicle battery prices ranged between 125 and 150 euros per kilowatt-hour. This range is for LFP batteries and NMC622 or NMC712 batteries, respectively. By 2030, costs could fall to between 95 and 110 euros per kilowatt-hour. Globally, lithium ion batteries dominate about 90% of the fixed battery storage market. The price of these systems is decreasing, but at a slower pace than vehicle batteries. In 2022, grid-side energy storage systems cost between 300 and 400 euros per kilowatt-hour. Other types of battery storage systems have varying costs. Lead-acid and zinc-bromine redox flow batteries cost between $150 to $400 per kilowatt-hour. A 10-kilowatt-hour home energy storage system costs $600 to $2,000 per kilowatt-hour, which is much pricier than grid-scale storage systems.

Most leading battery manufacturers in the EU are European branches of East Asian firms. In 2022, the EU’s estimated capacity was about 75 GWh per year. However, actual production is different. Achieving rated capacity may take up to five years. By 2030, the EU’s manufacturing capacity might reach about 886 GWh per year. This would fulfill 89% of the EU’s expected battery demand. This deep dive into the industry highlights the significant role battery technology has in the EU’s net-zero future.

Anticipated Surge in Lithium Ion Battery Production

The EU faces several issues. It heavily depends on third countries for raw materials. Furthermore, the EU lacks lithium refining capabilities. Companies in the EU don’t have much experience in mass-producing lithium-ion batteries. Plus, battery production equipment is mostly imported from Asia. EU-based companies face huge challenges in mass-producing batteries at globally competitive prices. Currently, the EU’s focus is on developing high-performance batteries like nickel-rich NMC. Lower performance chemicals like LFP, sodium-ion, or redox flow are not a priority for European companies.

In the last four years, about $300 billion was announced for investments in new lithium ion battery megafactories. This includes $131 billion in 2022 alone. Thanks to these investments, the global output of lithium-ion batteries should increase fivefold by 2030. China is expected to lead this growth with a 70% increase. This will add 102 new megafactories and 31 terawatt-hours of extra capacity. Generally, raw material costs significantly influence total battery costs, typically accounting for 50-70%. As a result, future costs are sensitive to key raw material prices, given market volatility. Battery material supplies are usually concentrated in specific countries or regions. In 2020, the global market value of lithium-ion batteries exceeded that of lead-acid batteries. Lithium ion sales should surpass lead-acid sales in 2022 if this trend continues.

The EU has a strong hold on the lead-acid battery market. It’s a net exporting economy, with a turnover of over 7 billion euros. Europe contributes around 20% to the global supply, or about 75 GWh per year. In lithium ion battery production, the EU provides about 7% of the global supply. China supplies around 77%, and the U.S., about 5%. All in all, the EU is strong in integrated/final products like electric vehicles and fixed storage. But it’s weaker in raw materials, advanced materials, and lithium-ion battery manufacturing equipment.