From China to Global: The Battery Expansion 2023

Table of Contents

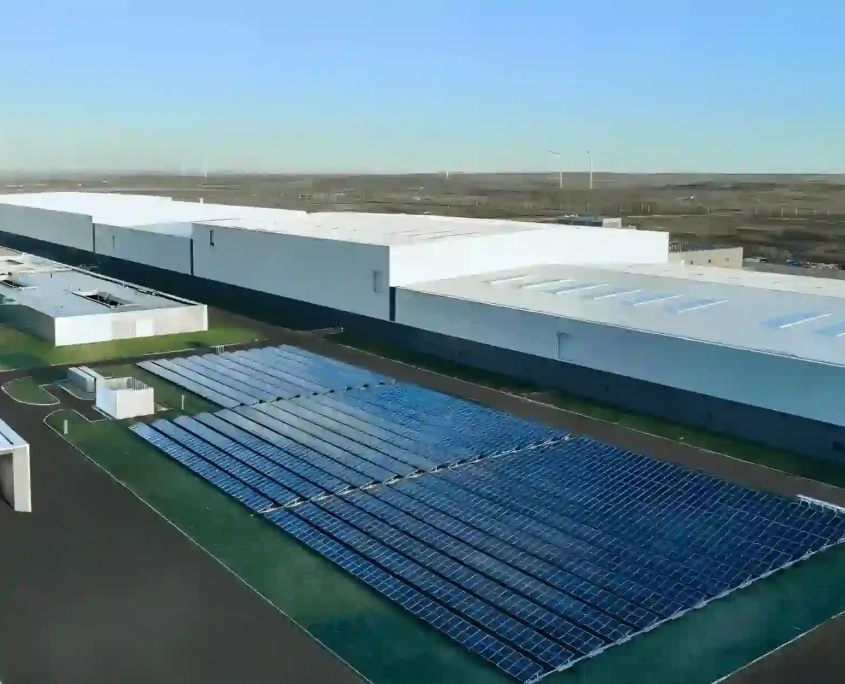

China's Battery Overcapacity: Global Expansion Becomes Essential

By 2025, China's battery production capacity is expected to hit 3,000GWh. However, the projected battery shipments for that year will be around 1,200GWh, leading to a significant overcapacity. This means that domestic battery factories are already ramping up their output, but this growth comes with the challenge of overproduction. To effectively utilize this excess capacity, it's essential for battery companies to expand globally.Leading battery manufacturers like Ningde Times and Gotion High-Tech are not only bridging gaps in the supply chain but also bearing the responsibility of breaking through market constraints and exploring further market growth.So, how can the issue of battery overcapacity be addressed? The most direct method is by increasing the market penetration rate of new energy vehicles, thus elevating the demand for batteries. Another approach is for batteries to "go overseas" – penetrating foreign renewable energy markets and supplying batteries to international automakers.Data shows that in 2022, the global battery installation capacity was 517.9GWh, marking a 71.8% year-on-year growth. Among this, Chinese battery companies held six spots, continuously growing their market share to 60.4%, a significant jump from 48.2% in 2021.China produces 70% of the world's batteries. However, the domestic demand is only about half of the global demand. This imbalance implies a need to target foreign markets, especially significant markets like Europe and America. With the West pushing for localization of electric vehicles and battery supply chains, it's inevitable for Chinese battery companies to establish factories overseas.