More Products:

IEA: EV Demand To Surge 35% This Year

2022 set a global EV sales record, trend to persist in 2023

In 2022, over 10 million EVs were sold globally, showing exponential growth in the market. EVs accounted for 14% of all new cars sold in 2022, up from approximately 9% in 2021 and less than 5% in 2020. Three major markets led EV sales globally in 2022. China once again took the lead, with around 60% of worldwide EV sales. Currently, over half of the EVs on the road worldwide are in China. The country has surpassed its own 2025 target for new energy vehicle sales.

Europe was the second-largest EV market globally. In 2022, EV sales in Europe grew by over 15%. This means that at least one in every five cars sold was electric. The U.S. was the third-largest market, with a 55% increase in EV sales in 2022, accounting for 8% of the car market.

In 2023, EV sales trends are expected to remain strong. In the first quarter, global EV sales exceeded 2.3 million units, around 25% more than the same period last year. According to the International Energy Agency, by the end of 2023, global EV sales will reach 14 million, a year-on-year increase of 35%. EV purchases will likely accelerate in the second half of 2023, and EV sales may account for 18% of total car sales globally.

Encouraging signs are emerging in the global EV market, although on a small scale. Outside the three major sales markets of China, Europe, and the U.S., EV sales are generally low, but increased in India, Thailand, and Indonesia in 2022. Compared to 2021, these countries’ combined EV sales doubled to 80,000 units. In 2022, EVs accounted for just over 3% of car sales in Thailand, while the average share in India and Indonesia last year was around 1.5%.

Policies and incentives from various countries will boost EV sales, and the extremely high oil prices, comparable to last year, may further drive potential buyers.

EV policies advance, nudging closer to climate objectives

With the support of industry policies and market trends, the future of EV sales looks bright. According to the International Energy Agency’s base policy scenario (STEPS), based on current policies and firm goals, the global share of EV sales will increase to 35% by 2030, up from less than 25%.

Under the current policy environment, the forecast demand for electric vehicles will have a profound impact on the energy market and climate goals. Based on existing policies, in the International Energy Agency’s base policy scenario, the oil demand for road transport is expected to peak around 2025. By 2030, the oil replaced by EVs will exceed 5 million barrels per day, and the use of EVs can reduce carbon dioxide equivalent emissions by about 700 million tons.

Both the EU and the U.S. have passed relevant legislation to match their ambitions for electrification. The EU has adopted new CO2 standards for cars and trucks consistent with the 2030 targets in the “Fit for 55” package. The U.S., due to the Inflation Reduction Act (IRA) and some states adopting the “California Advanced Clean Cars II” rules, EVs may account for half of the market share in 2030, consistent with national goals. The implementation of the recent emission standards proposed by the U.S. Environmental Protection Agency will further increase this share.

Given the bright prospects for EVs, battery production is expanding. By March 2023, the battery production capacity pledged for delivery by 2030 is sufficient to meet the demand set by government commitments, and even the demand for EVs under a net-zero emissions scenario by 2050. Consequently, the sales share of EVs could very well exceed the predictions based on current government policies and national goals.

More consumption, competition spur affordable EVs

In 2022, global EV spending surpassed $425 billion, a 50% increase from 2021. Government spending only accounted for 10% of this, the rest came from consumers. Investors also remained confident in EVs, as stocks of EV-related companies have consistently outperformed traditional car manufacturers since 2019. In 2022, venture capital for start-ups developing EVs and battery technologies flourished, reaching nearly $2.1 billion, a 30% increase from 2021. Investments in batteries and key minerals are also increasing.

In 2022, most buyers chose sport utility vehicles (SUVs) and large cars. In China and Europe, these vehicles accounted for 60% of all-electric cars, and even more in the U.S., mirroring the trend in the fossil-fuel car market. In 2022, CO2 emissions from SUVs powered by fossil fuels exceeded 1 million tons, much higher than the 80 million tons from EVs. Electric SUVs usually have batteries two to three times larger than those of smaller cars, meaning more key minerals are needed. In 2022, electric SUVs displaced over 150,000 barrels of oil per day, avoiding corresponding tailpipe emissions.

The competition in the EV market is intensifying. More and more new entrants are coming in, primarily from China and some other emerging markets, offering more affordable models. Existing major car manufacturers are also ambitious, especially in Europe, where there were significant moves in the EV space in 2022-2023: fully electric fleets, cheaper cars, more investment, and vertical integration with battery manufacturing and key minerals.

Consumers have more EV options. In 2022, the number of available EV models reached 500, at least double from 2018. However, original equipment manufacturers (OEMs) outside of China need to provide more affordable, competitively priced options to encourage more widespread adoption and use of EVs. Today, the number of available EV models and styles is still far lower than that of fossil fuel cars on the market, but the latter’s model count has been steadily declining since peaking around 2015.

EV growth prompts focus on electrified mobility

Electrification in road transport isn’t just about cars. Two- and three-wheeled vehicles are currently the most electrified segments; in emerging markets and developing economies, they outnumber cars. In 2022, over half of the tricycles registered in India were electric. They are becoming increasingly popular due to government incentives and lower lifecycle costs compared to traditional models, especially when fuel prices are high. In many developing economies, two- and three-wheeled vehicles provide an affordable mode of transport, and their electrification is vital for supporting sustainable development.

The level of electrification in commercial vehicles is also continually increasing. In 2022, global sales of electric light commercial vehicles (LCVs) increased by over 90% to over 310,000 units, even as overall LCV sales fell by nearly 15%. In 2022, nearly 66,000 electric buses and 60,000 medium and heavy trucks were sold globally, accounting for 4.5% of all bus sales and 1.2% of all truck sales. In places where governments have committed to reducing public transport emissions, such as dense urban areas, the sales share of electric buses is higher; in Finland, the sales share of electric buses in 2022 was over 65%.

Electric heavy-duty vehicle intent rises in 2022

vehicle models were added to the global market, bringing the total to over 800, supplied by over 100 original equipment manufacturers (OEMs). Governments in 27 countries have committed to achieving 100% zero-emission bus and truck sales by 2040, and the US and EU have also proposed stricter emission standards for heavy-duty vehicles.

Increasing demand for electric vehicles has led to greater attention being paid to the EV supply chain and batteries in policy-making.

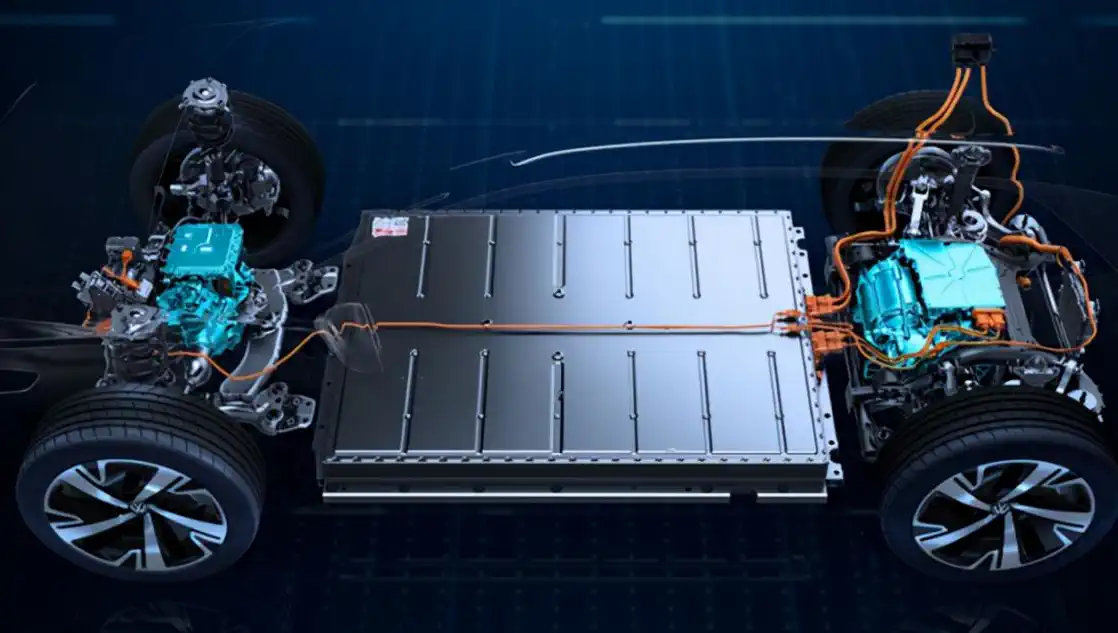

The rising demand for EVs has driven demand for batteries and related minerals. Due to the growth in EV sales, demand for automotive lithium-ion batteries increased by 65%, from about 330 gigawatt-hours in 2021 to 550 gigawatt-hours in 2022. In 2022, approximately 60% of lithium, 30% of cobalt, and 10% of nickel were used in EV batteries. Just five years ago, these shares were 15%, 10%, and 2% respectively. Reducing demand for these key materials is important for maintaining and ensuring the sustainability, resilience, and security of the supply chain, especially considering recent price developments in battery materials.

New alternatives to traditional lithium-ion batteries are emerging. Currently, the share of lithium iron phosphate (LFP) batteries has reached an all-time high, mainly in China: about 95% of electric light-duty vehicles (LDVs) using LFP batteries are manufactured in China. The supply chain for sodium-ion batteries is also being established, with current manufacturing capacity exceeding 100 gigawatt-hours, almost all in China.

The global EV supply chain is expanding, but manufacturing is still highly concentrated in certain regions, with China being a major player in battery and EV parts trade. In 2022, 35% of exported EVs came from China, up from 25% in 2021. Europe is China’s biggest trading partner for EVs and their batteries. In 2022, the share of EVs manufactured in China and sold in the European market increased to 16%, up from about 11% in 2021.

The EV supply chain is increasingly at the forefront of policy-making, with the aim of building supply chain resilience through decentralization and diversification. In March 2023, the European Union proposed the Net-Zero Industry Act, aiming to meet nearly 90% of the EU’s annual battery demand from EU battery manufacturers by 2030, with a manufacturing capacity of at least 550 gigawatt-hours. India is promoting domestic manufacturing of EVs and batteries through the Production Linked Incentive (PLI) scheme. The US Inflation Reduction Act emphasizes strengthening domestic supply chains for EVs, EV batteries, and battery minerals, as specified in the criteria for clean vehicle tax credits. From August 2022 to March 2023, following the announcement of the Inflation Reduction Act, major EV and battery manufacturers announced total investments of at least $52 billion in the North American EV supply chain, with 50% allocated for battery manufacturing and approximately 20% for battery components and EV production.