Expanding Electric Vehicle Market: Chinese Automakers in Europe

Table of Contents

- Expanding Electric Vehicle Market: Chinese Automakers in Europe

- Expanding Horizons: The Economic Impact of Chinese Auto Factories in Europe

- Rising Tide: The Growth of China’s New Energy Vehicle Exports

- Navigating the High Seas: Addressing the Logistic Challenges of New Energy Vehicle Exports

- Trailblazers and Pioneers: The Evolution and Future of China’s Auto Industry

- Global Expansion Success Stories: Chinese Automakers Abroad

- Conclusion

- Learn More About Battery

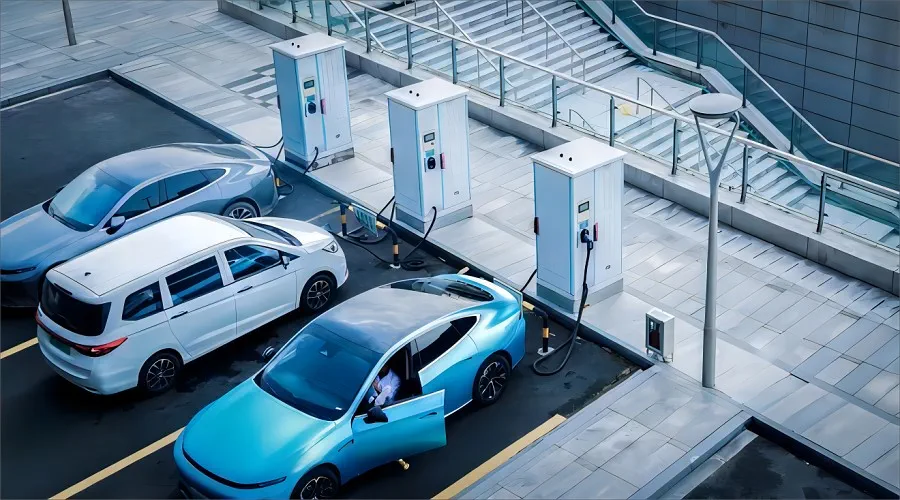

In the fast-paced world of automotive manufacturing, the shift towards electric vehicles (EVs) marks a pivotal evolution in industry dynamics, particularly for Chinese automakers. This evolution is not just about technology but also about strategically conquering new territories and establishing a significant presence in the European market. As companies like BYD, Geely, and Great Wall Motors navigate through the complexities of international trade, logistics, and consumer preferences, they are setting new benchmarks in the electric vehicle market. This article delves into the transformative journey of Chinese auto manufacturers as they expand beyond their borders, exploring the economic impact, market access, and consumer perception that come with setting up manufacturing facilities in Europe.

The decision to establish factories overseas is driven by more than the desire to tap into new markets; it’s a strategic response to global economic pressures, trade barriers, and a commitment to sustainability. This narrative unfolds through the examination of successful overseas establishments, logistic challenges, and the broader implications of these moves on the global stage. By doing so, Chinese automakers are not just exporting cars; they are fostering technological exchange, creating jobs, and promoting environmental sustainability.

Expanding Horizons: The Economic Impact of Chinese Auto Factories in Europe

Establishing manufacturing facilities in Europe offers significant benefits for Chinese automobile companies, especially those in the electric vehicle industry. This move not only aids in overcoming logistical challenges and trade barriers but also improves market access and consumer perception, crucial for companies like BYD and others in the new energy vehicles sector.

Economic Impact: Job Creation and Local Investment Opportunities

The decision to set up factories in Europe, such as BYD’s consideration of a location in France, directly translates into job creation and boosts local economies through substantial investments. When a major player in the electric vehicle market like BYD establishes a manufacturing base, it injects millions into the economy, not just through the construction of the facility but also via ongoing operations and maintenance. For instance, the investment often involves building infrastructure, purchasing local materials, and employing a local workforce, which significantly reduces unemployment and improves the standard of living in the region.

Market Access: Overcoming Trade Barriers and Protectionist Measures

European markets are known for their stringent trade policies and protective measures, particularly towards the automotive sector. By establishing local production facilities, Chinese companies can avoid high tariffs and non-tariff barriers that typically apply to imports. This strategic move allows companies to sell their cars more easily within the European Union, aligning with trade agreements and regulations, thereby enhancing the market presence of new energy vehicle exports from China.

Consumer Perception: Enhancing Brand Image and Product Acceptance

Local manufacturing also plays a critical role in changing consumer perceptions. European consumers tend to trust locally made products more, which can significantly enhance the brand image and acceptance of Chinese new energy vehicles. A factory in Europe means that Chinese brands like BYD can market their vehicles as locally produced, which not only aligns with European values of sustainability but also reduces the environmental impact associated with long-distance shipping of vehicles.

Rising Tide: The Growth of China’s New Energy Vehicle Exports

China has emerged as the world’s leading exporter of automobiles, with new energy vehicle exports playing an increasingly pivotal role in this dominance. This growth not only underscores China’s rising influence in the electric vehicle market but also brings to light the complex challenges related to logistics and shipping capacities.

China as the World’s Largest Car Exporter

In recent years, China has surpassed other nations to become the largest car exporter globally. The country’s automotive industry has evolved rapidly, transitioning from producing primarily for domestic consumption to becoming a major player in the international market. This shift is driven by substantial investments in automotive technology, particularly in the electric vehicle industry, where China is seen as a frontrunner.

Trends and Statistics in New Energy Vehicle Exports

The surge in exports is most notable in the sector of new energy vehicles (NEVs). These vehicles, which include hybrids and fully electric cars, have seen a dramatic increase in demand worldwide, especially in Western Europe. In 2023 alone, companies like BYD reported exporting over 243,000 units, marking a significant milestone in China’s automotive export history. This uptick is aligned with global shifts towards greener, more sustainable vehicle options, positioning Chinese NEVs as both competitive and desirable in the international market.

Logistical Challenges and Shipping Capacities

However, the increase in exports has not come without its challenges. The logistics of shipping large volumes of vehicles across continents are daunting. One poignant example is the situation with BYD’s Explorer No.1, the first roll-on/roll-off ship deployed by BYD, which set sail on January 16, 2023, carrying 5,449 NEVs from the Shenshan Xiaomo International Logistics Port to Europe. Despite its large capacity, the Explorer No.1 represents just a fraction of BYD’s shipping needs. Given the ship’s 40+ days travel time to Europe and back, the current fleet is insufficient to meet the growing demand. This has highlighted a critical bottleneck in the global roll-on/roll-off ship availability, exacerbated by years of underinvestment in this specific type of maritime infrastructure.

Global Response and Strategic Adjustments

The shortage of shipping options has prompted Chinese car manufacturers to rethink their export strategies. Beyond increasing maritime capacities, there is a strategic pivot towards establishing manufacturing bases within key markets like Europe. This not only circumvents logistical challenges but also aligns with trade agreements that favor locally manufactured goods, thereby enhancing market access and consumer perception.

The rise of China as a dominant force in the electric vehicle industry has brought with it significant logistic challenges, particularly in sea transportation. The case of BYD’s Explorer No.1 and the broader global shortage of car carrier ships illustrate the complexities and necessary strategic responses to keep pace with the booming demand for new energy vehicles.

Global Shortage of Roll-on/Roll-off Ships

The current global fleet of roll-on/roll-off ships is inadequate to handle the surge in vehicle exports, particularly electric vehicles. A report by Clarkson Research points out that from 2024 to 2030, the world will need to build an additional 100-200 new car carrier ships to accommodate the expected growth in vehicle shipments. This shortage is more acute given the specific needs of electric vehicles, which require more sophisticated handling and storage solutions to ensure safety and integrity during long sea voyages.

The Economic Impact of Insufficient Logistic Infrastructure

The lack of adequate shipping capacity not only affects manufacturers like BYD but also has broader economic implications. Delays in shipping schedules can lead to inventory build-ups, increased costs, and lost sales opportunities, ultimately impacting the economic impact of the electric vehicle market. This situation also underscores the importance of strategic planning and investment in logistic infrastructure to support the continued growth of new energy vehicle exports.

Meeting the Rising Demands Through Increased Investment

To address these challenges, there is a clear need for increased investment in maritime logistic infrastructure. This includes not only more ships but also enhanced port facilities and handling technologies that can cater to the specific needs of new energy vehicles. Additionally, manufacturers are exploring alternative strategies such as local assembly and manufacturing in key markets like Western Europe to reduce reliance on sea transportation and mitigate the risks associated with global logistics.

Strategic Implications for the Future

The logistic challenges faced by the electric vehicle industry require a multifaceted approach that combines immediate measures to increase shipping capacities with long-term strategies aimed at improving the overall efficiency of the supply chain. These efforts will be critical in maintaining the competitive edge of Chinese new energy vehicle manufacturers and ensuring that they can meet the global demand effectively.

Trailblazers and Pioneers: The Evolution and Future of China’s Auto Industry

The journey of China’s automotive industry from early ventures to becoming a dominant force in the global market offers a compelling narrative of innovation, expansion, and strategic foresight. This historical context sets the stage for understanding the current state and future directions of Chinese car manufacturers as they continue to expand overseas.

Early Ventures: Setting the Stage

The initial steps into international manufacturing by Chinese auto companies like Chery and FAW in the early 2000s marked the beginning of China’s ambitious plan to position itself as a global automotive power. These early ventures, although modest, laid the groundwork for the expansion that would follow. Chery, for example, established its first international plant in Iran in 2001, a strategic move that opened doors to other markets in Asia and the Middle East.

Geely and Great Wall Motors: Expansion and Localization

As Chinese automakers gained confidence and experience, the scale of overseas investments grew. Geely’s establishment of a manufacturing facility in Belarus in 2016 and Great Wall Motors’ construction of a full-process production plant in Tula, Russia, in 2015 are testaments to this evolution. These facilities were not just assembly plants but included all major processes: stamping, welding, painting, and assembly. This approach not only ensured control over the quality and supply chain but also significantly boosted the local economic impact in these regions.

Future Outlook: Strategic Expansions and Local Integration

Looking forward, the future of Chinese car manufacturers appears focused on deeper integration into key international markets. The rise of the electric vehicle industry and China’s significant role in it underscore the strategic importance of local production facilities. By setting up more factories in markets like Western Europe, Chinese manufacturers can mitigate risks associated with trade barriers and shipping logistics while enhancing their market access and consumer perception.

Navigating Challenges and Seizing Opportunities

As Chinese automakers venture further abroad, they face challenges such as cultural differences, regulatory compliance, and competition from established local brands. However, the historical success of companies like Geely and Great Wall Motors provides a blueprint for navigating these challenges. Moreover, leveraging trade agreements and fostering good relations with local governments and communities will be vital for future success.

Global Expansion Success Stories: Chinese Automakers Abroad

As the Chinese automotive industry continues its global expansion, several case studies highlight the successful establishment of overseas manufacturing facilities. These ventures not only demonstrate China’s growing influence in the electric vehicle industry but also underscore the strategic importance of market access, consumer perception, and adherence to trade agreements. This chapter examines key successes from Great Wall Motors, Geely, and BYD as they establish a significant presence abroad.

Great Wall Motors in Russia

In 2015, Great Wall Motors embarked on a groundbreaking project by building its first full-process production facility outside China, located in Tula, Russia. This facility, which includes stamping, welding, painting, and assembly processes, represented a major investment of over $500 million. With an annual capacity of 150,000 units and a localization rate of 65%, the factory marked a significant step towards integrating into the local market while reducing dependency on imports. The establishment of this factory not only bolstered the local economy through job creation but also improved Great Wall Motors’ market access and brand perception in Russia and Eastern Europe.

Geely’s Operations in Belarus

Geely’s strategy of expanding into Belarus in 2016 involved setting up a factory in the Borisov region. This facility, which represented an investment of $345 million, included comprehensive manufacturing capabilities similar to those of Great Wall Motors in Russia. Geely’s Belarusian factory was pivotal for tapping into the European market, offering a strategic base to circumvent logistical challenges and trade barriers that might affect imports. The presence of this factory in Belarus enhances Geely’s ability to adapt quickly to European market demands and regulatory standards, which is crucial for the electric vehicle market.

BYD’s Expansion into Thailand, Brazil, and Other Countries

BYD has taken a more diversified approach by establishing manufacturing facilities in Thailand and Brazil, among other countries. These factories are part of BYD’s strategic plan to address both local and regional markets more effectively. For instance, the factories in Thailand and Brazil allow BYD to leverage local advantages such as lower labor costs, proximity to essential raw materials, and favorable trade agreements within ASEAN and Mercosur economic zones. This global network of factories not only helps BYD reduce its operational costs but also boosts its exports significantly, particularly in the realm of new energy vehicles.

Conclusion

As we look at the strides made by Chinese automakers in the international arena, it is clear that their expansion is not merely a business strategy but a robust response to the global demand for sustainable transportation solutions. The establishments of factories in strategic locations like Europe do more than just mitigate trade barriers; they bring Chinese innovation closer to global consumers, enhance the economic impact in host countries, and significantly contribute to the growth of the new energy vehicle exports.

The journey of companies like BYD, Geely, and Great Wall Motors exemplifies a broader trend in the electric vehicle industry—one where geographic and technological boundaries are increasingly blurred. Whether it’s through the establishment of a state-of-the-art facility in Tula, Russia, or pioneering new markets in Thailand and Brazil, these companies are not only adapting to change but are also driving it. As they continue to navigate through logistic challenges and capitalize on favorable trade agreements, the future for Chinese automakers looks not just promising but also pivotal in leading the global shift towards electric vehicles.

By integrating into local economies, adhering to environmental standards, and enhancing consumer perceptions, Chinese automakers are setting the stage for a future where they are seen not as outsiders but as integral players in the global automotive landscape. This proactive approach in overcoming challenges and seizing opportunities is what will continue to define their path forward, ensuring that the industry’s drive towards innovation and sustainability remains strong.