Farasis Energy’s Lithium Battery Market Strategy

Table of Contents

In the highly competitive field of power batteries, choosing the right technology is key. Initially, ternary batteries had an edge due to their higher energy density. But with improvements in lithium iron phosphate battery technology, which now supports electric vehicles with a range of 500 km, the gap has closed. Car manufacturers are now leaning more towards lithium iron phosphate batteries, which have overtaken ternary batteries in market share.

Since its founding in 2009, Farasis Energy has focused on developing, producing, and selling lithium batteries and battery systems for new energy vehicles. Their main products are ternary soft-pack power batteries. Their key clients, Mercedes-Benz, GAC Group, and Siro, contribute over 80% of their revenue.

In the first quarter of 2024, Farasis Energy saw reduced losses. Their net loss was 217 million yuan, an improvement of 87 million yuan from the previous quarter and 134 million yuan year-over-year. Their gross margin increased from 1.91% to 11.89%. Farasis Energy explained that the low gross margin last year was due to high-cost inventory, which has now mostly been sold.

However, Farasis Energy is still facing losses. Since going public in 2020, they have had four consecutive years of losses, totaling nearly 4.1 billion yuan from 2020 to 2024. The losses are due to rising raw material costs like lithium carbonate, declining sales, inventory write-downs, asset impairment losses, and investment losses. Farasis Energy has struggled with the fluctuating lithium battery market, changing market competition, and expanding into overseas markets.

Chairman Wang Yu stated that the losses were due to inadequate management capabilities and lack of international market experience to handle the rapidly changing market. Recently, Farasis Energy reported that their inventory has decreased from 7.3 billion yuan at the end of 2022 to about 3.3 billion yuan now, reducing the pressure of high-cost inventory on future performance. Additionally, overseas investment losses are narrowing, and they expect better results starting in 2024.

To achieve profitability in 2024, Farasis Energy plans to enhance their management capabilities, place capable individuals in key positions, and evaluate performance based on results. They are also looking to expand the market for their new SPS products and emerging markets like low-altitude electric aircraft. Despite intense domestic competition, Farasis Energy aims to focus on overseas markets for sales growth.

Though Farasis Energy faced significant losses in 2023, their revenue is growing. More revenue is coming from overseas markets due to the growth in the domestic new energy vehicle market and product exports. Last year, Farasis Energy shipped over 16 GWh of power batteries, generating revenue of 16.436 billion yuan, a year-over-year increase of 41.84%.

However, in the first quarter of 2024, Farasis Energy’s revenue decreased. Despite a slight increase in shipment volume, the company achieved revenue of 2.924 billion yuan, down 21.70% year-over-year and 43.82% quarter-over-quarter. Farasis Energy attributed this decline to a drop in product unit prices.

Farasis Energy’s Strategy in the Lithium Battery Market

In a highly competitive industry, choosing the right technology path is crucial for power battery companies. Initially, ternary batteries had an advantage due to higher energy density. However, with the improved energy density of lithium iron phosphate (LFP) batteries, meeting the 500 km range needed by electric vehicles, the advantage of ternary batteries has diminished. Led by car companies, LFP batteries have surpassed ternary batteries in market share.

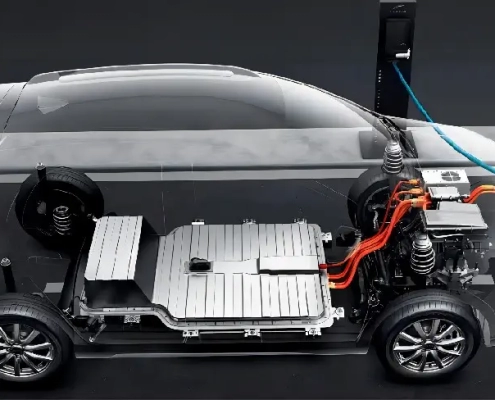

Power lithium batteries can also be classified by packaging: prismatic, cylindrical, and soft pack. Prismatic batteries use metal materials like aluminum for packaging; cylindrical batteries have a metal shell in a cylindrical shape; soft packs use aluminum-plastic composite film, making them more flexible than the other two.

LFP batteries are typically prismatic or cylindrical. Nowadays, prismatic batteries have high market acceptance and dominate the mainstream route. According to GGII, in 2022, domestic power battery installations totaled 260.93 GWh, with prismatic batteries accounting for 241.09 GWh, or over 92%. Cylindrical batteries, like those from EVE Energy, have advantages in performance, such as fast charging and low temperature, making them ideal for mid-to-high-end models.

Once car companies choose a packaging type, they rarely change it unless there are significant changes in packaging technology. Soft pack batteries are struggling in this competitive environment. Additionally, safety is a challenge for soft pack batteries. Their casing is an aluminum-plastic film, which is lighter but prone to swelling or damage upon impact. Thus, soft pack batteries are less safe compared to prismatic and cylindrical batteries for use as power batteries. However, due to the lack of a metal casing, soft pack batteries have higher energy density, making them suitable for drones or smartphones.

As a core customer of Farasis Energy, Mercedes-Benz has slowed its electrification pace. In their annual report, they mentioned that consumer acceptance of electric vehicles is lower than expected, leading to a slower rollout. They now expect to cut the number of electric models sold by half by 2030. In the first quarter of 2024, Mercedes-Benz sold 47,521 pure electric vehicles, down 8% year-over-year.

Currently, Farasis Energy’s SPS soft pack batteries are installed in Geely Radar pickups and have secured orders from Dongfeng, with other clients in the testing phase.

Conclusion

Despite the shift in market preferences, Farasis Energy continues to innovate. Their focus remains on soft-pack batteries, which use a flexible aluminum-plastic composite film. This choice offers higher energy density, suitable for various applications, including drones and smartphones. While soft-pack batteries face challenges like safety concerns compared to prismatic and cylindrical batteries, they still hold potential in specific markets.

Farasis Energy is also adapting to market demands. Their SPS soft-pack batteries are now used in Geely Radar pickups and are gaining traction with other clients like Dongfeng. As Farasis Energy navigates these changes, their commitment to advancing battery technology and meeting market needs remains steadfast.