Toyota 2024: Innovations and Economic Challenges

Table of Contents

As Toyota Motor Corporation sails into fiscal year 2024, the automotive giant is setting bold new records while steering towards an innovative future. In the fiscal year 2023, Toyota Motor Corporation achieved unprecedented financial success, marking a significant milestone in its history with a revenue surge and record-breaking profits. This financial triumph is not just a reflection of robust sales but also an emblem of Toyota’s strategic pivot towards electrification and advanced technology investments. As the world shifts more towards sustainable transportation, Toyota is not just keeping pace but is accelerating its efforts, particularly in the realms of electric vehicles (EVs) and software technologies. This introduction lays the groundwork for exploring Toyota’s financial strategies, investment in future technologies, and its implications for the global automotive landscape.

Toyota’s Financial Forecast for 2024: A Glimpse into the Future

On May 8th, Toyota Motor Corporation announced its consolidated financial statements for the fiscal year 2023 (April 2023 to March 2024) and its consolidated financial forecast for the fiscal year 2024 (April 2024 to March 2025). The financial data revealed that in fiscal year 2023, Toyota revenue reached approximately 45.09 trillion yen, a significant increase of about 7.94 trillion yen or roughly 21% compared to the previous fiscal year. Operating profit soared to approximately 5.35 trillion yen, up by about 2.63 trillion yen or more than 96%, setting a new record; pre-tax profits were about 6.97 trillion yen, nearly 90% higher than the previous year; and net profit reached approximately 4.94 trillion yen, more than double the previous year’s figure.

This marked the first time that Japanese corporate operating profits have exceeded the 5 trillion yen threshold. Toyota Motor Corporation’s president, Koji Sato, believes that these financial achievements reflect the company’s core merchandise-focused business strategy and the ongoing consolidation of its business foundation.

Looking ahead to fiscal year 2024, Toyota anticipates a sales increase of 2% to 46 trillion yen; however, operating profits are expected to decline by 19.7% to 4.3 trillion yen, and net profits are projected to decrease by 27.8% to 3.57 trillion yen. This expected fluctuation in performance is mainly due to the company’s increased investments in electric vehicles and artificial intelligence technologies, totaling about 2 trillion yen, as it transforms into a mobility company.

Toyota’s Performance Leap: Record Profits and Electrification Drive

Toyota Motor Corporation attributes its profit growth during the reporting period to several key factors. The surge in operating profit is largely due to increased sales of electrified vehicles centered on hybrid models, a better profit structure from high-revenue models, price adjustments in markets like North America and Europe, currency fluctuations, and efforts to cut costs which offset the rising prices of raw materials.

Official figures for the fiscal year 2023 show that the Toyota Group, which includes Toyota, Lexus, Hino, and Daihatsu, achieved a global cumulative sales volume of approximately 11.09 million vehicles, marking a 5% year-over-year increase. Specifically, Toyota vehicles accounted for about 9.443 million units, up 7% from the previous year; sales of Toyota and Lexus electrified models (including HEV, PHEV, BEV, and FECV) totaled approximately 3.855 million units, a significant rise of 35.3%, increasing their share of total sales from 29.6% the previous year to 37.4%.

This boost in sales volume propelled Toyota’s operating profit margin from 7.3% in the previous fiscal year to 11.9% in 2023, with operating profit surpassing 5 trillion yen for the first time—nearly double that of the previous year. For comparison, in 2023, Tesla’s operating profit margin stood at 9.2%, showing a decline of 7.6 percentage points, while Volkswagen Group reported an operating profit of 22.6 billion euros with a return on sales of 7.0%.

Notably, Toyota’s previous record for operating profit was 2.99 trillion yen in the fiscal year 2021, and this year’s figure is over 2 trillion yen higher, making it the first publicly listed Japanese company to exceed 5 trillion yen in operating profits.

For fiscal year 2024, Toyota forecasts sales to reach 46 trillion yen, with operating profits expected at 4.3 trillion yen—down 1.05 trillion yen from 2023—and net profits anticipated to be 3.57 trillion yen, a decrease of 1.37 trillion yen.

On the sales front, Toyota estimates that its vehicle sales for fiscal year 2024 will approach 9.5 million units, representing a slight year-over-year increase. Electrified models are expected to account for 4.827 million units, a 25.2% increase from the previous year, further raising their proportion of total sales to 46.4%.

Toyota’s Strategic Investment in Electric Mobility and Software Innovation

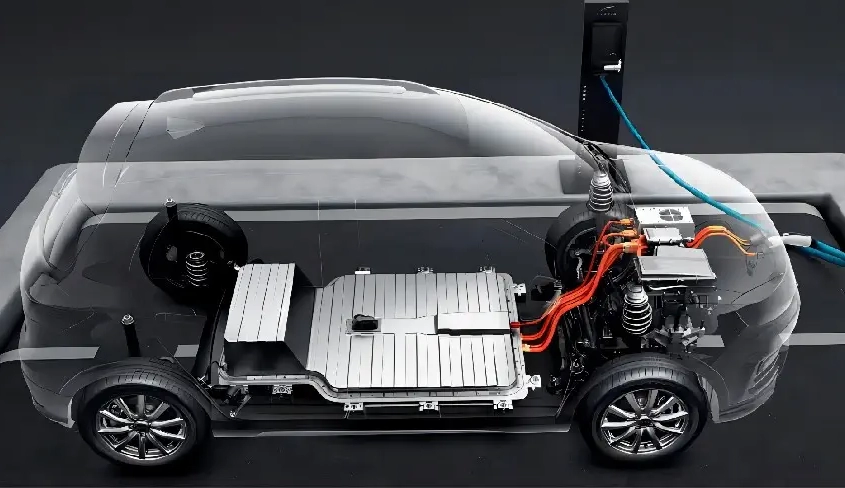

It’s important to note that during the financial report briefing, Toyota Motor Corporation announced an additional investment of nearly 2 trillion yen in its transformation into a mobility company. Of this, approximately 1.7 trillion yen will be directed towards BEV (Battery Electric Vehicles), artificial intelligence, and software development. This investment covers both research and development (R&D) and capital expenditures, aimed at accelerating Toyota’s SDV (Software Defined Vehicles) and BEV initiatives.

This new investment represents an increase of 500 billion yen compared to previous allocations. Specifically, after this additional investment, Toyota’s capital expenditures in BEV and software development are expected to rise to 2.15 trillion yen, while R&D spending in these areas will reach a record high of 1.3 trillion yen.

Notably, in May of the previous year, Toyota had declared its intention to invest 5 trillion yen in BEV and related sectors by 2030, with the goal of reaching sales of 3.5 million BEV units by that year.

In China, Toyota continues to embrace its “multi-path” philosophy, simultaneously rolling out new BEV products and enhancing the development of PHEVs (Plug-in Hybrid Electric Vehicles). Recently, there have been reports that Toyota’s joint ventures in China plan to introduce plug-in hybrid technology in the next two to three years, potentially incorporating BYD’s DMI technology (super hybrid technology), with plans involving approximately two to three models. At the end of May, Toyota will hold a technical briefing to fully outline its electrification strategy, where more detailed information on PHEVs will be disclosed.

Conclusion

Reflecting on Toyota’s financial forecasts and strategic investments, it’s evident that the company is not just focusing on immediate gains but is diligently preparing for a future dominated by electric mobility and digital solutions. With substantial investments aimed at enhancing its capabilities in electric vehicles and artificial intelligence, Toyota Motor Corporation is poised to remain a formidable player in the automotive industry. The commitment to a “multi-path” approach, especially in dynamic markets like China, highlights Toyota’s adaptive strategies in response to global automotive trends. As fiscal year 2024 approaches, Toyota’s vision for electrification and innovation is set to redefine industry standards, promising a future where mobility is not only smarter and more efficient but also more sustainable. Through strategic foresight and relentless pursuit of innovation, Toyota continues to build a foundation that will support its leadership in the automotive sector for years to come.